Using BePick as a Resource

BePick is a useful platform for individuals seeking info on unemployed loans. The web site supplies complete critiques, comparisons of various loans, and insights into completely different lenders out there. Users can learn about interest rates, eligibility, mortgage quantities, and phrases simply by navigating by way of BePick's user-friendly interf

Users can discover clear explanations about loan varieties, application processes, and potential pitfalls to keep away from. By centralizing this data, 베픽 empowers debtors to make educated selections based mostly on their unique financial conditi

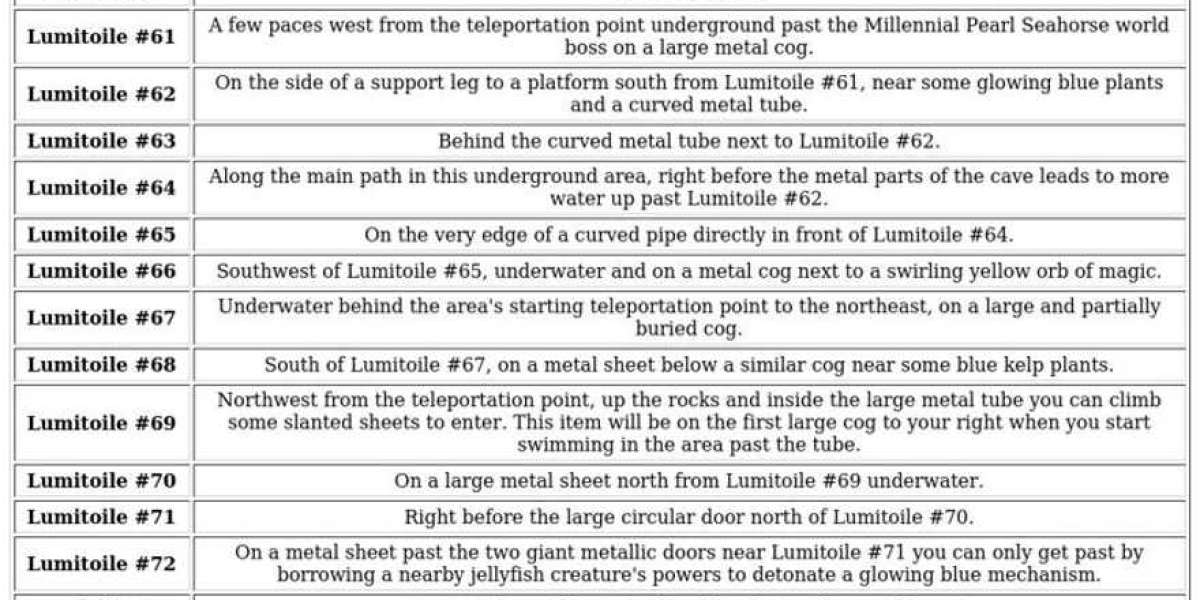

Term Loans

Business Lines of Credit

SBA Loans

Equipment Financing

Invoice Financing

Term loans are typically issued for a hard and fast period and are paid back in regular installments. These loans are sometimes used for long-term investments, similar to purchasing real estate or massive tools. Business traces of credit supply flexibility, allowing business owners to withdraw funds as needed up to a specified limit, making them ideal for managing cash circulate fluctuati

Who Qualifies for Unemployed Loans?

Eligibility for unemployed loans can vary considerably between lenders. Generally, most lenders require that you simply be actively seeking work or have a plan to secure employment to qualify. They may look at your *credit score*, previous financial habits, and any out there collateral. This ensures that you've got got a feasible pathway to repay the mortgage regardless of being unemplo

If you’re feeling unsure about which lender to choose on or the means to method your monetary challenges, BePick presents a supportive neighborhood of people with comparable experiences. Engaging with different users can provide real-world insights that information you toward a extra knowledgeable decis

Another major consideration is the loan’s objective. Clearly defining why you want a mortgage improves your possibilities of securing one. Additionally, lenders generally choose businesses that may articulate a solid plan for using the funds successfu

Additionally, should you anticipate difficulties in making funds, talk together with your lender instantly. Many lenders are keen to work with borrowers to create versatile fee plans. Proactively managing your loan not only alleviates stress but in addition builds a strong financial basis for the fut

Interest Rates and Fees Explained

The interest rates associated with low-credit loans range broadly based on factors including the borrower’s credit score historical past, the lender’s insurance policies, and the general market conditions. Typically, these charges are greater than those offered to prime borrow

One of the main advantages of unemployed loans is their accessibility. Lenders may think about factors beyond revenue stability, such as credit history or belongings. Consequently, people who might have been turned away by standard lenders might find aid via these specialised loans. However, rates of interest can be higher than standard loans as a end result of elevated danger lenders face when lending to unemployed individu

n To apply for an unemployed mortgage, Read Much more you usually need to provide identification (such as a driver's license), proof of earnings or unemployment standing, financial institution statements, and details about your monthly expenses. Ensuring all documentation is accurate will help facilitate the approval course

Moreover, some lenders providing unemployed loans might report payment histories to credit bureaus, which might help borrowers rebuild or enhance their credit scores if payments are made on time. This side may be beneficial for those looking to get well financially after a challenging inter

Low-credit loans are financial options designed for people with a less-than-perfect credit score score. These loans can be essential instruments for securing funds when standard lenders could deny functions due to poor credit score history. Understanding how low-credit loans work, their advantages and downsides, and the factors influencing them can empower borrowers to make informed selections. Websites like 베픽 provide comprehensive information and evaluations about low-credit loans, aiding consumers in navigating their borrowing options extra successfully. Access to pertinent resources could be the key to unlocking monetary solutions tailored to particular person circumstan

Many lenders also require candidates to provide documentation regarding their unemployment status. This might embrace a *termination letter*, unemployment benefit assertion, or other evidence confirming your present state of affairs. The extra transparency you present, the smoother the method will likely

What is a Business Loan for Delinquents?

A enterprise Debt Consolidation Loan is a sum of cash lent to a enterprise, sometimes to fund operations or enlargement. Unlike private loans, enterprise loans focus on the financial well being and operational wants of the enterprise itself. Utilizing funds from a mortgage might help in purchasing stock, hiring employees, or acquiring new gear. The terms of business loans can differ widely, relying on the lender's assessment of the business's creditworthiness and the aim of the mortg

Search

Popular Posts