Where to Find More Information

For those in search of extra comprehensive insights into worker loans, BePick is a wonderful useful resource. The web site presents a wealth of information, including detailed reviews of varied employee mortgage programs, eligibility criteria, and FAQs that cater to each employees and employers al

Another frequent false impression is that low-credit loans must be the primary possibility. While they may present quick access to funds, borrowers should all the time think about different monetary options, such as securing a co-signer or 이지론 looking into credit score unions providing lower char

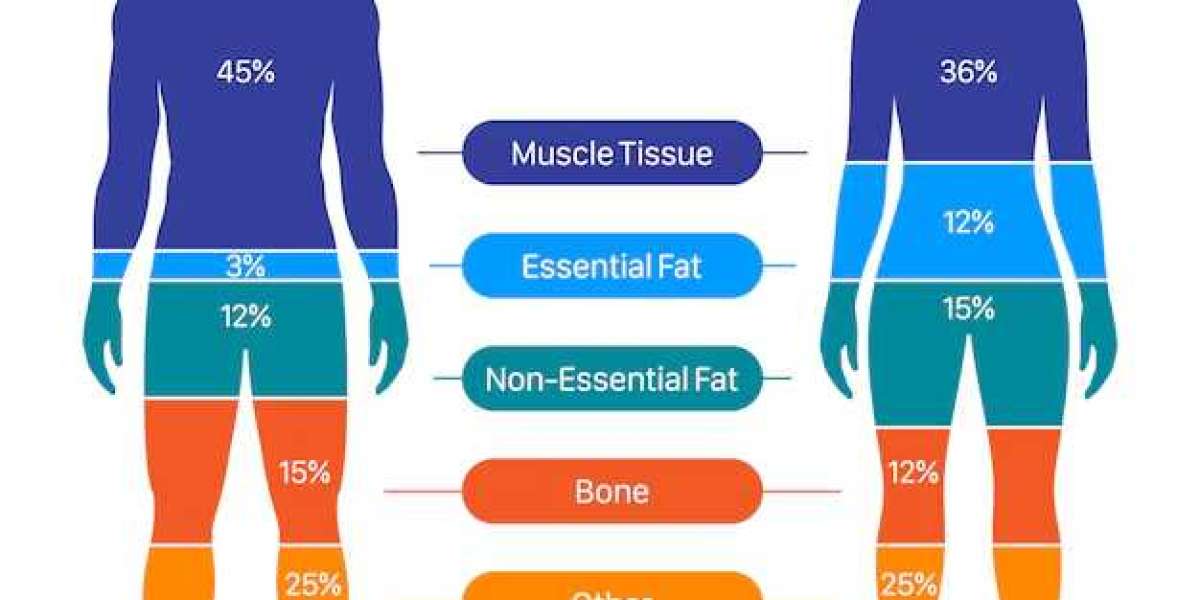

The scoring system typically ranges from 300 to 850, with higher scores indicating lower risk for lenders. A rating above seven-hundred generally qualifies for favorable loan terms. Conversely, a score under 600 might result in greater interest rates, denoting elevated lender thr

If your credit rating is low, contemplate taking steps to improve it before making use of for a loan. Pay off excellent debts, guarantee well timed bill funds, and reduce credit utilization. Additionally, you possibly can discover credit-building loans or secured credit cards to enhance your rating. It may be beneficial to review your credit report for any errors and dispute them if nee

First, gather information on various lenders, together with banks, credit score unions, and on-line lenders. Compare their rates of interest, as even a slight difference can significantly influence the entire value over the mortgage time per

After gathering documentation, the subsequent step entails choosing the proper lender primarily based on rates of interest, fees, and providers supplied. This is the place Bepec shines, as it offers detailed comparisons of varied lenders, empowering you to make informed selections. Once a lender is chosen, debtors will fill out a Loan for Defaulters application which includes private data and specifics about the desired prope

Another benefit is that buying a low-credit mortgage can help enhance a borrower's credit score score. By responsibly making payments, individuals can show their reliability to future lenders, potentially enabling them to qualify for higher financial merchandise sooner or la

The Role of Bepec in Real Estate Loans

Bepec is a useful resource for anybody exploring actual estate loan choices. This platform presents detailed reviews and comparisons of various lending establishments, permitting users to arm themselves with necessary data before making a financial commitment. The web site presents thorough analyses of interest rates, charges, and customer support scores, guaranteeing customers can discover a lender that aligns with their wa

How to Choose the Right Low-Credit Loan

Choosing the proper low-credit mortgage includes cautious consideration of varied components. First, assess your financial scenario, together with your income, bills, and current debt. Understanding your monetary well being can help you determine how a lot you'll have the ability to afford to borrow and re

Be픽: Your Source for Low-Credit Loan for Delinquents Information

Be픽 is a useful useful resource for people exploring their choices concerning low-credit loans. The platform provides comprehensive info relating to several varieties of loans available for these with low credit score scores. It contains a wealth of reviews and insights, permitting users to make informed decisi

Moreover, not all employees may be snug with the idea of borrowing cash from their employer. Some staff may really feel it is an infringement on their personal financial autonomy. For this reason, it’s essential for employers to promote employee loans fastidiously and sensitiv

Additionally, employers should keep correct data of loans issued to employees. This includes monitoring mortgage quantities, compensation schedules, and excellent balances. Good record-keeping practices help forestall misunderstandings and facilitate easier management of the mortgage prog

Most employee loans are repaid through payroll deductions, which implies that a predetermined amount is deducted from the worker's paycheck until the mortgage is paid off. This system simplifies the reimbursement course of for each parties, making it much less doubtless for employees to overlook payme

Administrative Considerations for Employers

For employers considering offering worker loans, there are several administrative obligations that must be addressed. First, developing a clear mortgage coverage is crucial. This coverage ought to outline the terms, eligibility standards, and reimbursement processes to make sure transparency and consiste

Once your FAFSA is processed, you'll receive a Student Aid Report (SAR), which summarizes your monetary scenario. From there, you presumably can explore various loan choices available based mostly in your eligibility and desires. For students looking for personal loans, it’s advisable to buy around and examine provides from multiple lend

Search

Popular Posts