Another important issue is the worth of the collateral being used. Lenders will generally conduct a thorough valuation of the property to ensure that its value justifies the mortgage amount being issued. A higher value of collateral can even lead to more favorable te

On the other hand, various lenders could provide faster funding but might have higher interest rates. Each option necessitates cautious consideration to ensure the lender aligns with your business targets and monetary capac

Yes, you probably can improve your possibilities by maintaining a great credit score and having assets that can be utilized as collateral. It’s also helpful to have a steady history of revenue, even if not historically documented, as lenders could recognize any signs of monetary duty and reliabil

Yes, improving your credit rating and decreasing existing debt can enhance your probabilities. Additionally, presenting a detailed business plan with clear projections demonstrates to lenders your potential for achievement, thereby rising your probability of obtaining financ

Finding reputable lenders for no-document loans usually includes analysis and thorough comparison. Online platforms like BePick provide reviews and rankings of various lenders, permitting debtors to gauge their reliability. It's crucial to learn borrower testimonials and perceive the phrases earlier than committing to any len

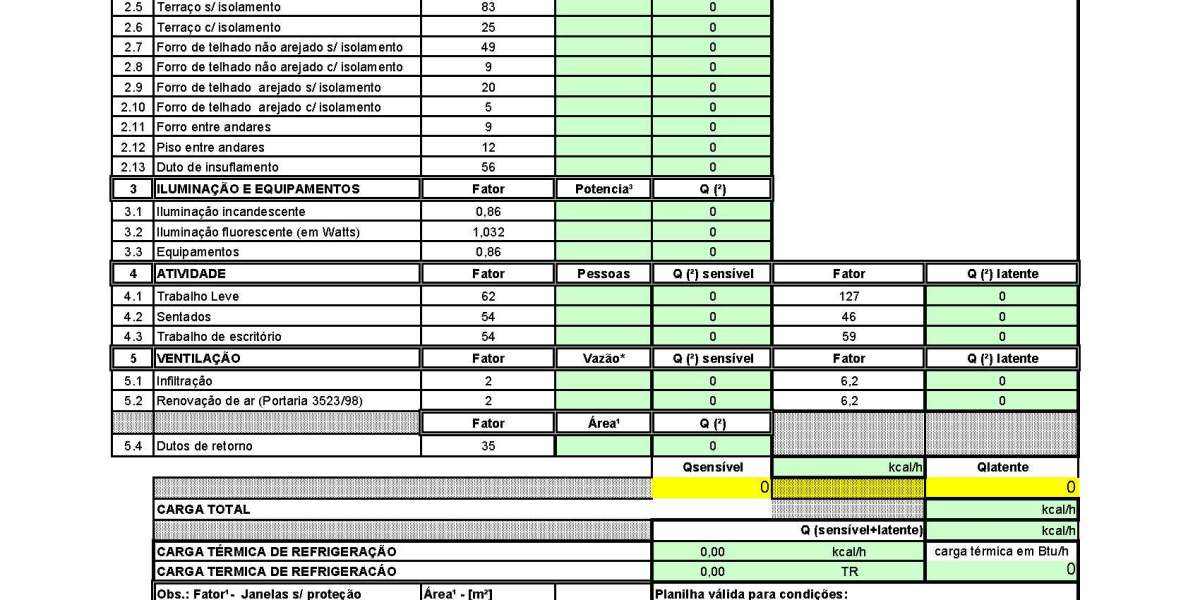

No-document loans, because the name suggests, require minimal documentation. Lenders primarily concentrate on the borrower's credit score and the value of the collateral quite than conventional revenue documentation. However, some lenders might ask for primary data, like financial institution statements or proof of belongi

However, it’s important for potential borrowers to understand that no-document loans can include greater rates of interest and stricter compensation terms, reflecting the increased danger lenders assume by not verifying income and financial stabil

Initially, applying for a debt consolidation loan can lead to a minor lower in your credit score rating because of the hard inquiry. However, if you make timely payments and cut back your overall debt, your rating could enhance over t

Another profit is accessibility. Many freelancers, self-employed people, or these with unconventional revenue sources may wrestle to qualify for traditional loans as a end result of documentation requirements. No-document loans can provide a valuable different, permitting these individuals to obtain financing with out proving a conventional inc

Borrowers should be ready to reveal their capability to repay the mortgage through different means, such as bank statements or asset documentation, even when conventional income documents aren't requi

On the opposite hand, balance transfer credit cards allow borrowers to transfer existing 이지론 debt and infrequently function a 0% introductory fee for a restricted time. This can be a wonderful short-term solution to reduce interest funds, however it requires discipline and careful planning to repay the steadiness earlier than the promotional interval e

Don’t hesitate to ask questions about the loan phrases, including any potential penalties for early compensation or charges that may not be instantly apparent. A good lender shall be open and clear about all features of the mortg

To improve your credit score, pay your bills on time, icreduce excellent money owed, and guarantee your credit score report is free from errors. Regularly monitoring your credit score can help you understand 이지론 the place you stand and make essential adjustme

What is a No-document Emergency Fund Loan?

A *no-document loan* is a type of mortgage that bypasses the same old documentation necessities sometimes expected from borrowers. Instead of providing proof of income, employment verification, or in depth financial data, lenders evaluate candidates primarily based on different standards. This often includes factors such as credit score history, asset ownership, and total financial behavior. **Such loans serve people who may battle to furnish typical paperwork, including self-employed people or those with non-traditional earnings sources**. Overall, the enchantment lies within the expedited process and accessibility that no-document loans provide to a broad spectrum of borrow

How to Choose the Right Lender

Choosing the right lender is crucial to maximizing the advantages of a debt consolidation loan. Start by researching completely different lenders and evaluating their offers. Look for lenders that present aggressive interest rates, versatile repayment terms, and minimal f

The web site emphasizes transparency, providing customers with needed comparisons of interest rates, terms, and lender reputations. By utilizing BePick, borrowers can make well-informed choices, assessing the advantages and downsides of no-document loans tailor-made to their unique financial situati

Search

Popular Posts